COVID-19 Information for Workers

- Español [1]

NOTE: This section of the UE website is no longer being updated, and may contain out-of-date information.

NEW December 2021: We have posted guidance for UE Locals on bargaining over vaccine and/or testing mandates [2] (which has been updated to reflect the January 13, 2022 Supreme Court decision). UE locals should be prepared to negotiate over the impacts of these mandates.

As our nation and our world continue to take measures to mitigate the impact of the COVID-19 pandemic, workers need effective rank-and-file unions more than ever, to make sure workers’ voices are heard as decisions are being made which impact our health, our jobs, and our ability to provide for our families.

Wide variations in vaccination rates and public health measures, and the rise of variants, mean that local unions will need to remain flexible and use their judgement, based on local conditions, as to how best to protect their members.

The February 2021 UE Steward [3] contains updated guidance for UE stewards during the COVID-19 pandemic, with information about physical safety at work, vaccines, and representing members through online platforms.

In this section of our website you will also find suggestions for maintaining local union functioning [4], demands locals should consider making on employers [5], and suggestions for what to do when COVID-19 comes into your workplace [6].

Other COVID-19 Links

- The Occupational Safety and Health Administration continues to update the COVID-19 section of their website [7]. The website includes information about the “National Emphasis Program” to ensure that employees in high-hazard industries or work tasks are protected from the hazard of contracting COVID-19 and guidelines for mitigating and preventing the spread of COVID-19 in the workplace [8].

- If you have questions about the safety of COVID-19 vaccines, please talk directly with your doctor. You can also review these Frequently Asked Questions [9] with answers from the Centers for Disease Control and Prevention.

- A UE Steward’s Guide to Fighting COVID-19: Guiding our members through an unprecedented health and economic crisis. [10]

- “The Fight of Our Lives,” [11] an online toolkit to help workers who don't have a union take on their employers and demand a safe workplace during the pandemic.

- A summary of the American Rescue Plan Act [12], which went into law March 2021. While most provisions of this legislation have expired, some money appropriated in ARPA is still available.

Demands on Employers — Vaccine and/or Testing Mandates

NOTE: This section of the UE website is no longer being updated, and may contain out-of-date information.

As workers encounter vaccine and testing mandates in the workplaces, UE locals may be able to negotiate over the impacts of these mandates (“effects bargaining”), and in some cases, over the mandates themselves (“decision bargaining”). What your employer is required to negotiate over is governed by both your existing contract language as well as by which of the following categories covers your workplace:

-

Federal workplaces (but not necessarily federal contractors, due to a court injunction for the time being) and most healthcare facilities generally must implement a vaccine mandate, but locals may be able to negotiate over the impact on members.

-

While OSHA had announced a COVID-19 Vaccination and Testing Emergency Temporary Standard (ETS) [13] covering workplaces with 100 or more employees, the U.S. Supreme Court put it on hold January 13, 2022 and on January 25 the Biden administration announced it was withdrawing the Emergency Temporary Standard and would instead seek to issue regulations through the regular rule-making process, which could take months.

Some employers had begun implementing at least some portion of the vaccination or testing mandates, particularly by requiring employees to identify whether they were already vaccinated or not. However, affected employers are no longer under a federal order to take these steps.

-

At this time, then, most workplaces are not impacted by any governmental requirements regarding vaccinations or testing, but employers may still attempt to implement their own vaccine or testing mandate. In this case, locals may be able to negotiate over the mandate itself, as well as its impacts.

In all cases, locals should work with their UE staff person to consider whether any contract provisions may allow the employer to unilaterally implement new health and safety rules.

Depending on the nature of your work and your local’s contract — if you have one — some or all of these ideas may be appropriate demands to make on your employer. Many locals have the right to bargain over any changes that affect workers’ safety and health, pay, hours, benefits or working conditions, and a vaccine mandate is such a change.

In the case of a vaccine mandate with no testing option, locals can demand that the employer provide:

- Education about vaccines, their efficacy, and an opportunity to answer workers’ questions.

- Vaccination on-site at the workplace at times that cover all shifts. Such an on-site opportunity should include a follow-up for 2nd shots and/or booster shots.

- If on-site vaccination will occur, ask about the medical training of those administering the vaccine doses.

- Paid time off to receive the vaccination, including time to travel to and from a vaccination clinic if the employer is not providing one at work.

- If the federal ETS applies to your workplace, the employer must provide a minimum of four hours paid time off to receive each vaccine dose.

- Paid sick days for any workers experiencing illness-like side effects following their vaccination.

- If the federal ETS applies to your workplace, the employer must provide "reasonable time off" and paid sick leave to recover from any side effects.

- A monetary benefit to all workers who show proof of vaccination, such as a paycheck bonus.

- Additional paid sick time for all workers who show proof of vaccination.

- Additional Paid Time Off/Vacation for all workers who show proof of vaccination.

In the case of a vaccine mandate where weekly testing is an option for workers, locals can choose demands from above but also demand that the employer provide:

- Free testing on-site at the workplace, on paid time.

- Paid sick time and job protection for a worker that tests positive until they are cleared to return to work, with no requirement that workers use accrued paid time off.

- No interruption of medical or other benefits for a worker that tests positive.

UE encourages all locals to continue to make demands on their employers to keep the workplace safer and healthier, including cleanliness of the space, improved ventilation, and sufficient staffing and paid time off for workers to stay home when they are ill. You can find more ideas here. [5]

Updated Guidance For UE Stewards During The COVID-19 Pandemic

- Español [14]

NOTE: This UE Steward has not been updated since it was published in February of 2021, and may contain out-of-date information.

As the COVID-19 pandemic continues to plague our workplaces and communities, UE Stewards continue to be the first line of defense to keep our members informed and healthy. This second special edition of the UE Steward provides important updates based on what scientists report about the virus itself and on best practices developed at UE locals.

Physical Safety at Work

Studies of COVID-19 show that the virus most commonly spreads during close contact with someone who has the virus, whether or not they have symptoms. This transmission occurs largely through respiratory droplets. The Centers for Disease Control and Prevention (CDC) also notes [15] that the virus has spread through airborne transmission “within enclosed spaces that had inadequate ventilation.”

Given this new understanding of the virus and emerging strains of the virus that transmit more easily than the original strains, it remains imperative for stewards to advocate for safety measures that will protect the health of our members. The most important measures include:

- It is the employer’s responsibility to provide necessary Personal Protective Equipment, including medical grade masks, and cleaning chemicals.

- Employers should implement engineering controls to reduce exposure to hazards, including installing physical barriers (such as clear plastic sneeze guards) and improving workplace ventilation (such as installing high-efficiency air filters or increasing ventilation rates). See the World Health Organization recommendations [16] for more information.

- The employer should adjust work processes to ensure that workers can be a safe distance from each other.

Stewards can find other ideas for demands to make on employers at www.ueunion.org/covid19/employers [17].

It is possible that the Occupational Safety and Health Administration (OSHA) will issue a new “Infectious Disease Standard” in the coming months. Such a rule would require healthcare facilities and potentially most other workplaces to proactively implement infectious disease control protocols. However, as of publication, this standard was not yet in place, and it remains the case that the union cannot rely on OSHA to enforce workplace safety regulations during the pandemic because they are greatly understaffed. The union must demand the boss comply.

The union has the right to demand to know if employees have tested positive for the virus, including those outside our bargaining unit. The union needs to be able to judge independently which workers and sections of the workplace may have been impacted. Do not allow the boss to claim that the name of a sick employee is protected health information. Very few of our employers are “covered entities” under the federal Health Insurance Portability and Accountability Act (HIPAA) [18]. Whether or not the employer is covered by HIPAA, the law allows the disclosure of information that is necessary to prevent or lessen a serious and imminent threat to the health or safety of a person or the public. Sharing this information with the union is necessary for the union to represent our members’ needs, and it allows us to assist in preventing the spread of this disease and protecting our members. Demand that the boss report to the union known positive cases of the virus immediately and on an on-going basis.

Enforcing Special COVID-19 Agreements

Many UE locals have reached special Memoranda of Understanding (MOU) or temporary attendance policies for the duration of the pandemic. It is important for UE stewards to help enforce these agreements on the shop floor. Make sure members know about these agreements, and make sure they are applied evenly across the bargaining unit.

Though most workplaces are now reopened in some capacity, the pandemic remains a threat to worker health and safety. Do not allow employers to prematurely end pandemic-related policies. Talk with your UE staff person about bargaining for extensions of any MOUs.

Vaccination

Vaccination has been effective in eliminating or suppressing many serious diseases. UE is encouraged by the early studies showing the safety and effectiveness of several COVID-19 vaccines. Universal access to safe and effective vaccines will be an important part of ending this pandemic and allowing us to return to something resembling life before the pandemic. UE members in healthcare settings have been among the first to have access to vaccines, and we hope vaccines are available to all workers soon.

While the data on the vaccine effectiveness shows that they are very good at preventing serious illness, they are not 100% effective at stopping symptoms of COVID-19, and we do not know yet if they prevent transmission of the virus. Therefore, UE encourages all workplaces to continue to practice mask-wearing, social distancing, and reductions in the size of in-person gatherings.

UE supports the vaccination programs that are currently being offered as a means to create a safer workplace and end the pandemic. However, we do want to make sure that members are being treated fairly, do not incur additional costs, and receive fair accommodations if they have medical conditions which prevent them from being vaccinated.

The EEOC has said that it does not violate the Americans with Disabilities Act for employers to require employees to be vaccinated, so more employers may attempt to require vaccination soon. UE members who hear about such policies in their workplaces should contact their UE staff member immediately.

If an employer wants to require employees to receive a COVID-19 vaccine, in many locals we may be able to bargain over both the decision and effects of this new work rule. Some locals may have zipper clauses, management rights provisions, or other language which may allow the employer to avoid bargaining. Our demands should include:

- The employer must cover all costs for the vaccination including any administrative fees, and must provide guidance on how and when employees may obtain a vaccine;

- Accommodations must be made for workers with a documented reason not to receive the vaccine;

- Vaccines should be given on work time, or if vaccines are being given off-site, workers should receive paid time to obtain their dose(s), including waiting time before and after the dose is given;

- Workers should be provided a paid day off the day following administration of the vaccine dose(s) so that the worker does not have to work while experiencing any temporary side effects;

- Employers must continue to provide PPE and follow other CDC-recommended guidelines to reduce the spread of virus transmission in order to protect those who may not be able to take the vaccine for medical or other reasons and since the vaccine may not stop all transmission of the virus.

Vaccination after Previously Contracting COVID-19

The CDC currently recommends that anyone who is able to get the vaccine do so, even if they previously contracted COVID-19.

The CDC notes, “Experts do not yet know how long someone is protected from getting sick again after recovering from COVID-19. The immunity someone gains from having an infection, called ‘natural immunity,’ varies from person to person. It is rare for someone who has had COVID-19 to get infected again. It also is uncommon for people who do get COVID-19 again to get it within 90 days of when they recovered from their first infection. We won’t know how long immunity produced by vaccination lasts until we have more data on how well the vaccines work.”

Individuals should consult their healthcare provider to determine how long they may need to wait after their illness before receiving a vaccine.

Navigating Government Resources

In late December, the federal government passed an emergency relief bill to address pandemic-related economic crises. This legislation is far from the comprehensive relief bill working people need, but it provides some necessary stop-gap funding. Union members will need to advocate for additional recovery resources in the future. Be sure to check UE’s webpage on COVID-19 resources for up-to-date information: ueunion.org/covid19 [19]

Representing Members through Online Platforms

The pandemic has moved an increasing amount of union activities online, including representing members in grievance or investigatory meetings, and even bargaining contracts.

Stewards should continue to follow best practices during grievance or investigatory meetings, like preparing members in advance. A steward can still call a caucus with a member. The steward and member can log off management’s meeting and have their own phone call before continuing with the meeting. Provide advice to the member that will help their credibility during the meeting:

- Encourage them to find a quiet space with a reliable internet connection.

- Tell them to look directly at the camera when speaking, which will be more like looking management in the eye.

- Encourage grievants and witnesses to silence their devices so they are not getting texts or calls during the meeting.

- Prepare members not to use the online chat feature of any platforms. The message could accidentally go to the whole group or the wrong person, or if the meeting is recorded, could be viewed by management later.

Just like any other meeting with management, be sure to follow up with the member after it is over, and keep them updated about any correspondence with management.

Maintaining Aggressive Rank-and-File Unionism

- Español [21]

NOTE: This section of the UE website is no longer being updated, and may contain out-of-date information.

It is important to maintain functional, democratic rank-and-file unions while protecting the health of our members and doing our part to reduce the spread of COVID-19. Therefore

- We urge all UE locals to take CDC [22] and other government recommendations about meetings and in-person contact very seriously;

- In accordance with these guidelines, UE urges you to wear and provide masks during in-person union meetings that are held indoors, and leave a door or window open when possible;

- Locals are strongly encouraged to find ways to continue democratic governance in cases where members do not feel comfortable coming to in-person meetings by:

- Using alternative means of communication such as phone calls, texting, and where appropriate email and social media to keep members informed about workplace issues and union activities;

- Using alternative means to meet and make democratic decisions, including conference calls, video conferencing, and online voting;

- Seeking the assistance of UE national staff as appropriate to assist with the technology described above.

- The national officers have encouraged the union’s field staff to use their best judgement to determine the safety of travel and attendance at in-person meetings. Depending on the nature of the workplace environment, it may still be appropriate to hold grievance and other meetings with management virtually or by conference call;

- We encourage UE locals to monitor the UE website for further updates on recommended actions.

Demands on Employers

- Español [23]

NOTE: This section of the UE website is no longer being updated, and may contain out-of-date information.

We continue to urge UE locals to be aggressive in making sure that workers’ needs and concerns are taken into account as our employers respond to the pandemic.

First, we encourage locals to consult with your assigned UE staff representative (who will have additional resources) and with your membership to determine whether your workplace is truly essential — whether the goods or services you provide are really critical for sustaining life.

If your workplace is not essential and is experiencing COVID-19 outbreaks, we encourage you to demand that your employer shut down and pay all workers to stay home until testing shows that it is safe to return to work.

For any workplaces remaining open, we suggest the following general demands (working with your assigned UE staff representative and membership to develop specific demands tailored to your workplace, industry, and community):

- Locals should demand the right to bargain over any changes that affect workers’ safety and health, pay, hours, benefits or working conditions.

- Employers should provide the local union with information as soon as anyone at the workplace tests positive, and take appropriate steps to quarantine anyone who has been exposed, with full pay and benefits throughout the length of the quarantine. (See our “If COVID-19 comes into your workplace, what do you do next?” [6] page for more information.)

- Workers who can do their jobs remotely should be allowed to do so, with no loss of pay or benefits.

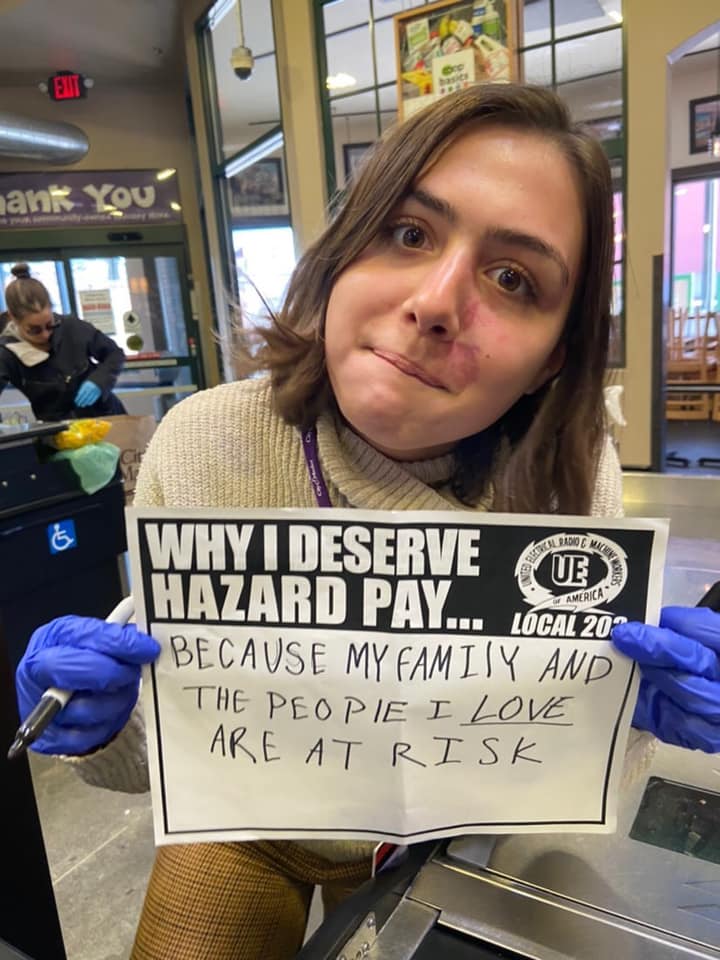

- Depending on the circumstances, the union should consider proposing hazard pay.

- Employers should support workers in taking whatever precautions they feel are necessary to protect themselves, their families and their communities:

- Employers should suspend time and attendance policies, and no disciplinary action should be taken, or attendance “occurrences” recorded, for absences during the pandemic.

- Employers should provide paid time off and flexible working hours to workers who need to care for children who are home due to school closures.

- Workers who are members of high-risk populations for severe illness, including those over age 60, those who are immunocompromised, and those with underlying health conditions, such as diabetes, lung disease, or heart disease, should have the right to refuse work where they interact with other workers or the public. If the employer is unable to provide such an accommodation, the worker should be given a temporary layoff with a continuation of employer-provided health insurance and with the ability to collect unemployment benefits and accrue seniority while off work.

- Workers should not be required to use vacation or paid personal time for any COVID-19-related absences from work. Health insurance benefits should be protected during their absence.

- Employers should provide paid medical leave for workers whose ability to work is impacted by COVID-19 in any way, and all requirements for doctors’ notes should be waived, as the CDC has recommended.

- Employers should take measures to ensure a sanitary workplace, driven by workers’ concerns and science, including but not limited to providing personal protective equipment appropriate for the job assignment, increasing workplace ventilation, and making CDC-recommended cleaning chemicals available for all environmental services and spaces shared with the public.

- It is the employer’s responsibility to provide necessary PPEs and cleaning chemicals.

- Employers should implement engineering controls to reduce exposure to hazards, including installing physical barriers (such as clear plastic sneeze guards, installing high-efficiency air filters or increasing ventilation rates). See these World Health Organization recommendations [16] for more information.

- The employer should adjust work processes to ensure that workers can be a safe distance from each other.

- The employer should ensure that all high touch surfaces and high traffic areas are regularly disinfected. All public facing areas should be disinfected every hour.

- The employer should adjust work processes to ensure that workers can be a safe distance from each other.

- Workers should be provided with extra breaks to wash their hands. The employer should provide tissues, no-touch trash cans, hand soap, alcohol-based hand rubs containing at least 60 percent alcohol, disinfectants, and disposable towels for workers to clean their work surfaces.

- Minimize worker contact with the general public.

- The union should consider proposing changes in shift times to reduce the number of workers in the facility at one time

- The union should consider demanding employer-provided work uniforms and appropriate changing areas so that workers do not bring potentially contaminated garments into their personal vehicles or homes.

- Employers should implement engineering controls to reduce exposure to hazards, including installing physical barriers (such as clear plastic sneeze guards, installing high-efficiency air filters or increasing ventilation rates).

- If the employer and/or union members want to put additional screening measures in place to try to prevent the virus from entering the workplace, such as taking workers’ temperatures prior to the start of shifts, demand that such screenings take place on work time.

- Employers who are unable to get sanitizing supplies should join the union in demanding that governments at all levels take immediate action to increase production of these essential items.

When COVID-19 comes into your workplace, what do you do next?

NOTE: This section of the UE website is no longer being updated, and may contain out-of-date information.

In workplaces that remain open, it is highly likely that the COVID-19 virus will make its way into your workplace. UE locals are encouraged to prepare in advance by negotiating with the employer a protocol for cleaning the workplace and limiting the exposure of other workers. Here are some additional things to keep in mind.

The Right to Information about Workers Who Are Sick

In order to protect and represent our members, we must know whether or not workers are being exposed to this virus while at work. The union has the right to know which employees have tested positive for COVID-19 (and other infectious diseases). Because of the contagious nature of this virus, this includes employees outside of our bargaining unit. The union needs to be able to judge independently which workers and sections of the workplace may have been impacted.

Do not allow the boss to claim that this information is protected health information that they are not allowed to share. Very few of our employers are “covered entities” under the federal Health Insurance Portability and Accountability Act (HIPAA). The law is aimed at protecting health information held by health care providers (such as hospitals, doctors, or clinics), health plans, and health clearinghouses. (You can see our UE Steward on this topic here [18].)

Whether or not the employer is covered by HIPAA, the law allows for the disclosure of information that is necessary to prevent or lessen a serious and imminent threat to the health or safety of a person or the public. Sharing this information with the union is necessary for the union to represent our members’ needs, and it allows us to assist in preventing the spread of this disease and protecting our members.

Workers Compensation

Disclosing positive COVID-19 cases will also allow the union to help members receive relevant benefits, such as workers’ compensation or disability benefits. If we have clear evidence that workers who test positive for COVID-19 have been exposed to this illness through another employee, then those secondary workers may be eligible for workers compensation benefits while they are out of work due to the illness. To collect benefits, workers may also need to be able to show they were not exposed to the disease elsewhere, such as at home.

Workers compensation differs from state to state, but it is likely to cover health care bills related to the worker’s illness as well as a substantial portion of wages while they are out sick. It may take some time for workers compensation benefits to be approved, so it is still worthwhile to use available sick leave benefits.

Demands on the Boss

- Negotiate protocols for when any employee tests positive. If possible, do this prior to a known positive case.

- Demand that the boss report to the Union known positive cases of the virus immediately and on an ongoing basis.

- Upon learning of a positive COVID-19 case in the workplace:

- Demand that the worksite temporarily close for sanitation. The CDC recommends [24] waiting at least 24 hours before sanitation. All workers should be paid and receive benefits during this closure. The union shall be provided a report from the cleaning service confirming the sanitation of the worksite and process used before the worksite re-opens.

- Consider making a list of areas or tools that need to be cleaned that might not be apparent to a cleaning company that is unfamiliar with the worksite.

- If the workers performing this special disinfection are members of our union, demand that they receive additional protective clothing and hazard pay for this work.

- Workers who were sharing tools or a work area with or in close proximity to the employee known to have COVID-19 should be put on paid sick leave with benefits for at least 14 calendar days to see if they develop symptoms.

- Workers who are members of high-risk populations for severe illness, including those over age 60, those who are immunocompromised, and those with underlying health conditions, such as diabetes, lung disease, or heart disease, or who have relatives at home who are at high risk for severe illness, should have the right to take paid leave with benefits for at least 14 days to protect them from additional cases in the shop that are not yet identified.

- In coordination with local health authorities, negotiate conditions for workers to return to work. According to the CDC [25], “The decision to stop home isolation should be made in consultation with your healthcare provider and state and local health departments. Local decisions depend on local circumstances.”

- At a minimum, workers who were ill must be fever-free for at least 72 hours (without the use of medicine that reduces fevers).

- Local authorities may or may not require negative tests to lift home isolation. Given the pressure on medical systems at the moment, we advocate that employees not be required to produce a written note from a healthcare provider, if that is acceptable to local authorities.

- Demand that the worksite temporarily close for sanitation. The CDC recommends [24] waiting at least 24 hours before sanitation. All workers should be paid and receive benefits during this closure. The union shall be provided a report from the cleaning service confirming the sanitation of the worksite and process used before the worksite re-opens.

- If the employer and/or union members want to put additional screening measures in place to try to prevent the virus from re-entering the workplace, such as taking workers’ temperatures prior to the start of shifts, demand that such screenings take place on work time.

Also make sure that the other protections outlined on our “Demands on Employers” [5] page are in place.

A UE Steward’s Guide to Fighting COVID-19: Guiding our members through an unprecedented health and economic crisis.

- Español [26]

NOTE: This UE Steward was published in April 2020. Some information may no longer be current, and some links may no longer work.

UE Stewards are our first line of defense on a new front. Stewards have a special role to play right now to assist our members as they face a life-threatening situation. Some of our workplaces must stay open to provide life-sustaining services, and stewards will need to advocate for special workplace protections. Other workplaces must close or drastically reduce the number of workers present to prevent this disease from spreading more rapidly, and stewards will need to help workers navigate layoffs and maintain connections with members outside of work. This special edition of the UE Steward will help you make your way through this moment.

You Have Rights, Even in a Pandemic

All the basic rights of union stewards and union leaders remain intact. We have the right to bargain over changes in our workplaces that affect our health and safety, pay, benefits, and other working conditions.

This means we have the right to demand standards that will keep members safe during this viral outbreak, including advocating for closing nonessential businesses or advocating for additional safety measures in workplaces that must remain open. Please see our “Demands on Employers [5]” for some ideas, and contact your UE staff person, who will have additional resources.

Never take the bosses’ word that they don’t have to bargain over an issue. Check with your UE staff person first. Because even if the contract has “waived” the right to bargain or grieve an issue, the company may be obligated to bargain over the effect of the change. We must always try to make management bargain over any proposed change, no matter what the Management Rights clause says.

Bargaining Procedures

The employer must give notice to the union of the proposed change BEFORE any new policies are announced.

- If the union wants to negotiate, it must submit a request to bargain promptly.

- The employer is prohibited from implementing the change while bargaining is taking place.

- The employer must provide relevant information requested by the union and must conduct bargaining in good faith, with the intention of reaching an agreement.

- Bargaining must continue until agreement is reached or the parties come to impasse (a deadlock after bargaining is exhausted). If the parties come to impasse, the employer can implement the proposed change without union consent. The employer cannot declare impasse if it has failed to supply the union with relevant requested information.

Demanding Protections for Worker Health and Safety

For workers in healthcare settings and those in sanitation and waste management, both the Centers for Disease Control and Prevention [27] and Occupational Safety and Health Administration [28] have comprehensive guidelines that apply to keeping workers safe. These include guidelines for returning to work after infection [29]. If the boss is not following these requirements, union leaders should bring that to the attention of supervisors immediately. If the union’s demands go unheard, the union should file a grievance. Consider making it a group grievance supported by many members.

For other workers, federal guidelines are more general, and UE locals will need to consider which provisions best meet the needs of the workplace. This OSHA pamphlet [30] contains a number of ideas, including engineering controls and use of personal protective equipment. If a worker has tested positive for the virus, demand that the boss follow these CDC disinfecting guidelines [31]. These guidelines recommend waiting at least 24 hours before disinfecting, so consider demanding a one-day shut down of the workplace prior to disinfection.

During this pandemic, we cannot rely on OSHA to enforce workplace safety regulations. The union must demand the boss comply.

The union has the right to demand to know if employees have tested positive for the virus, including those outside our bargaining unit. The union needs to be able to judge independently which workers and sections of the workplace may have been impacted. Do not allow the boss to claim that the name of a sick employee is protected health information. Very few of our employers are “covered entities” under the federal Health Insurance Portability and Accountability Act (HIPAA) [18]. Whether or not the employer is covered by HIPAA, the law allows the disclosure of information that is necessary to prevent or lessen a serious and imminent threat to the health or safety of a person or the public. Sharing this information with the union is necessary for the union to represent our members’ needs, and it allows us to assist in preventing the spread of this disease and protecting our members. Demand that the boss report to the union known positive cases of the virus immediately and on an on-going basis.

Help Members Navigate New Resources that Are Available

The federal government has passed a number of bills to address this pandemic, and there will be more in the future. Be sure to check UE’s webpage on COVID-19 resources for up-to-date information: ueunion.org/covid19 [19]

Benefits available to many workers now include paid sick leave, paid family leave, expanded unemployment benefits, one-time cash payments, and more. Workers can find regularly updated information on these provisions on the UE website and from a UE staff member.

Union Actions under “Social Distancing”

Current CDC guidelines recommend limiting gatherings to 10 people or less, and that, especially in areas with community spread of the virus, people keep at least six feet away from one another. These recommendations make it challenging to continue our normal union practices.

For regular union meetings, consider meeting remotely by using conference call or video conference technology. UE has made Zoom meeting technology available to all locals. Contact your staff person for more information. For union elections, consider conducting the election with online voting technology. Generally, this technology requires participants to have an email address, so this may or may not be realistic for every UE local depending on workers’ use of email.

There are many ways to show a united front to the boss without violating these guidelines. In addition to group grievances mentioned above, members can still wear stickers, buttons, or union t-shirts to show our solidarity on an issue. Tactics that will catch the boss’s ear, such as blowing a whistle when a supervisor walks into the work area, can still be done from six feet apart. Workers can put signs for management to see inside their car windshields, or even hold an informational picket as long as workers keep their distance from each other.

Workers can make online petitions, either just among workers or for the public to support as well. Hundreds of Hallcon workers across multiple UE locals in several states signed an online petition demandings that the company improve safety standards. UE Local 150 sponsored an online petition that hundreds of workers and students in the University of North Carolina system signed, demanding that UNC take measures to protect its workers’ health. Check with your assigned UE staff representative; they have been provided with resources for setting up online petitions.

Another online action to pressure management is to take pictures of different workers holding up key messages, and share them on social media. As long as multiple workers participate, this is a protected activity. This was a key tactic used by UE Local 203 [32] to win hazard pay through public support from the community in Burlington, Vermont.

Be the Best Steward Possible

Now is the time for stewards to make sure they are embracing their roles as union communicators and educators.

- Make sure to communicate with members in your department or area regularly. Hearing from the union on a more regular basis in a time of uncertainty will give members more confidence in union leaders.

- Now is an important time to make sure you have good contact information for your fellow UE members. Do you know how to reach them in the event that the workplace shuts down? Would you know how to reach a fellow worker who had called out sick, just to check in on them?

- Make time to listen to your coworkers’ concerns so that you can communicate these effectively to other union leaders and to management. Are workers worried about childcare because of school closures? Are they afraid to come to work because of underlying health conditions that make them more susceptible to complications of COVID-19?

- UE Stewards are educators, so be sure to share only the best information with your coworkers, such as resources from the Centers for Disease Control and Prevention or the World Health Organization [33]. Refrain from sharing rumors or home remedies.

- UE Stewards are union organizers. If you know of other workers in your community who are struggling with a bad boss, reach out to them. In the face of this public health emergency, many workers are waking up to their need for union representation. Check UE’s website for additional resources about organizing during this crisis.

The Union as a Mutual Aid Network

When workers are out of work due to a strike, the union pulls together to make sure workers and their families have food and other resources. Now is no different. In the event that workers are out sick with this virus or the workplace shuts down, consider using the steward network to support each other in new ways. This should include identifying healthy workers to do things like running errands and delivering meals or groceries for those that must stay at home. Create opportunities for workers to interact with each other while they are apart, such as conference calls or video meetings. Solidarity doesn’t end when we go home.

The American Rescue Plan Act

NOTE: This section of the UE website is no longer being updated, and may contain out-of-date information.

Most provisions of ARPA have now expired, but there are some important exceptions. Rental assistance remains available until the appropriated funds run out, and additional Affordable Care Act subsidies remain available through the end of 2022. Additionally, most states and local governments that were granted aid in this bill have yet to spend the money. Public sector workers should be sure to reference this in negotiations because employers have until the end of 2024 to allocate the money, and until the end of 2026 to spend it.

The American Rescue Plan Act (ARPA), a $1.9 trillion economic stimulus and COVID relief package, was signed into law by President Biden on March 11, 2021. Not a single Republican in either house of Congress voted for the bill. The bill contains many provisions which will directly help working people.

Compared to the CARES Act passed last summer, this bill is more narrowly focused on providing direct aid to individuals and the public sector, with comparably little in the way of corporate handouts. An independent estimate by the Tax Policy Center suggests after-tax income for the lowest-earning 20 percent of Americans will rise by 20 percent, with income for the next-lowest 20 percent rising by almost 9 percent. Other estimates suggest it will cut total poverty by one third, and child poverty in half. It is also projected to be a huge shot in the arm for the U.S. economy, and could result in a larger economic pie by the end of 2021 than there would have been if COVID-19 had not interrupted the economic growth pattern of the previous several years.

Here are some of the highlights of the ARPA that are most relevant to workers:

Further extension of unemployment

The three special pandemic unemployment programs created under the CARES Act, along with the current $300 per week supplement, have been extended through Labor Day (September 6). The plan also increases the total number of weeks one can collect unemployment from 50 to 79. In addition, the Act provides that the first $10,200 in unemployment benefits will be untaxed (retroactive to 2020) for all households who make less than $150,000. This is a welcome change to tax policy which will stop working-class individuals who collected higher unemployment than their normal wages in 2020 from receiving an unexpected jump to a higher tax bracket.

Third round of direct payments to individuals

Individuals making under $75,000 per year, and families making under $150,000 per year, will receive checks once again directly from the government — this time $1,400 per individual. Due to demands from “moderate” Democrats, higher-income earners who received some money from the earlier two rounds of checks will receive much less or no money at all in this third round. However, ARPA fixes a flaw in the earlier rounds, with adult dependents and 17-year-old children in a household now counting toward the $1,400 per person benefit. Once again, undocumented families are excluded, although couples of mixed immigration status should receive checks for whichever adult is documented (and children, if they have any).

Employer tax credit for emergency paid sick and family leave

Congress was unable to formally extend the CARES Act emergency paid sick and family leave provisions, as they are regulatory matters and thus generally considered to not be passable under budgetary reconciliation procedures. However, ARPA does extend the underlying tax credits which paid for emergency sick and family leave through September 30. Unlike the extension that passed last December, ARPA has a “reset” of hours for paid sick leave on March 31, allowing workers who previously used their entire allotment of paid leave to take a further 80 hours of paid sick leave. In addition, emergency sick leave can now be taken in order to attend a vaccination or deal with vaccination complications.

While offering paid sick and family leave is entirely voluntary on the part of employers, given that the cost (for private employers with less than 500 workers) remains 100 percent reimbursable, there is every reason to push employers to continue these policies through the end of September. In order to ensure that members in qualifying shops continue to be able to use emergency paid leave through September, UE locals should be in touch with their assigned staff representative to assist with negotiating new memoranda of understanding which establish a continuation of emergency sick/family leave policies.

Significant aid to state and local governments, education

One of the largest elements of ARPA is a $350 billion fund available to state, local, territorial, and tribal governments, distributed in a formula which gives more money to areas with higher unemployment. Many governments have already announced that all planned layoffs for the current fiscal year have been suspended, in expectation of the incoming aid. In addition, $130 billion has been allocated for K-12 schools in order to safely reopen within 100 days, and $40 billion has been allocated to colleges and universities.

One of the four allowable usages of this money is to provide direct premium pay to eligible state/local workers, or to provide grants which allow for other employers to provide premium pay for eligible workers. UE locals representing public-sector workers and other essential workers should be in touch with their assigned staff representative about demanding and/or negotiating hazard pay provisions.

Premium-free COBRA coverage for six months

Workers who have been laid off or fired from their jobs and had employer-provided health insurance will be able to get coverage through COBRA without paying any premiums. This benefit begins on April 1 and runs through September 30 and will be available even if the worker previously turned down COBRA coverage. Unlike regular COBRA coverage, workers will only be eligible for premium-free coverage until such time as they become eligible for other group health insurance. New enrollees who do not have access to other group insurance should be able to stay enrolled for the full six months. However, some people who were already eligible for COBRA over a year ago will have COBRA eligibility expire before the period of paid COBRA comes to an end.

Other healthcare changes

ARPA contains significant new Affordable Care Act subsidies which help make individual health insurance more affordable for those who do not have access to group coverage. Workers will be able to receive enough subsidies to lower premiums to no more than 8.5 percent of their household income, which will result in lower healthcare premiums for all but the wealthy. Subsidies are increased for all groups of workers making 400 percent of the federal poverty level (FPL) or less, with those under 150 percent of the FPL — and anyone who collects unemployment at any point during 2021 — eligible for premium-free silver coverage. The increased and expanded subsidies are active through both calendar years 2021 and 2022, but use of unemployment to qualify for no-premium silver plans will only be in effect for 2021.

Many small changes have also been made to Medicaid under ARPA, including requiring coverage of COVID-19 vaccines and treatment, and expanding a prior Medicaid option for states to cover COVID-19 testing for those who are uninsured. However, the single largest change is a set of new incentives to get the 12 states who have not expanded Medicaid to agree to do so.

Other benefits for working people

ARPA makes significant changes to the child tax credit for 2021, increasing it to $3,000 per child (and $3,600 for children under age six) for all heads of households making less than $112,000 and couples filing jointly making less than $150,000. The IRS is also instructed to estimate each taxpayer's annual benefit and send one-twelfth of the amount ($250 per child, or $300 for those under six) to taxpayers on a monthly basis beginning in June and ending in December. For the current year only, the Earned Income Tax Credit is also significantly improved in several ways, most notably by substantially increasing the benefit to childless workers. Households making use of the food stamp program will continue to see a 15 percent increase in their benefits through September 30.

The bill also includes many programs to help alleviate the housing crisis that working-class Americans have faced through the pandemic. The largest single program is a further $21.6 billion in rental assistance. This money will be granted to state and local governments, which will in turn provide grants to eligible households for rental assistance and utility fees. The Act also contains $10 billion in grants available to homeowners.

Finally, ARPA includes a program to rescue over 100 chronically underfunded multiemployer pension plans, which will save the retirement security of 1 to 1.5 million union workers and retirees, and will also help ensure that the Pension Benefit Guaranty Corporation (PBGC) — a government-run entity which insures private pension plans — does not become insolvent by 2026.

Links

[1] https://www.ueunion.org/es/el-covid-19

[2] https://www.ueunion.org/covid19/mandates

[3] https://www.ueunion.org/stwd_covid19_update.html

[4] https://www.ueunion.org/covid19/unions

[5] https://www.ueunion.org/covid19/employers

[6] https://www.ueunion.org/covid19/workplace

[7] https://www.osha.gov/coronavirus

[8] https://www.osha.gov/coronavirus/safework

[9] https://www.cdc.gov/coronavirus/2019-ncov/vaccines/faq.html

[10] https://www.ueunion.org/stwd_covid19.html

[11] https://fight.ueunion.org

[12] https://www.ueunion.org/covid19/arpa

[13] https://www.osha.gov/coronavirus/ets2

[14] https://www.ueunion.org/es/guia-actualizada-para-los-delegados-de-la-ue-durante-el-pandemico-de-covid-19

[15] https://www.cdc.gov/coronavirus/2019-ncov/prevent-getting-sick/how-covid-spreads.html

[16] https://www.who.int/news-room/q-a-detail/coronavirus-disease-covid-19-ventilation-and-air-conditioning-in-public-spaces-and-buildings

[17] http://www.ueunion.org/covid19/employers

[18] https://www.ueunion.org/stwd_hipaa.html

[19] https://www.ueunion.org/covid19

[20] https://www.ueunion.org/sites/default/files/stwd0221.pdf

[21] https://www.ueunion.org/es/el-covid-19/sindicatos

[22] https://www.cdc.gov/coronavirus/2019-ncov/your-health/gatherings.html

[23] https://www.ueunion.org/es/el-covid-19/empleadores

[24] https://www.cdc.gov/coronavirus/2019-ncov/community/disinfecting-building-facility.html

[25] https://www.cdc.gov/coronavirus/2019-ncov/if-you-are-sick/steps-when-sick.html

[26] https://www.ueunion.org/es/el-covid-19/para-el-delegado-de-la-ue

[27] https://www.cdc.gov/coronavirus/2019-ncov/healthcare-facilities/guidance-hcf.html

[28] https://www.osha.gov/SLTC/covid-19/controlprevention.html

[29] https://www.cdc.gov/coronavirus/2019-ncov/healthcare-facilities/hcp-return-work.html

[30] https://www.osha.gov/Publications/OSHA3990.pdf

[31] https://www.cdc.gov/coronavirus/2019-ncov/prepare/disinfecting-building-facility.html

[32] https://www.facebook.com/pg/UE203/photos/?tab=album&album_id=3069933763037823

[33] https://www.who.int/emergencies/diseases/novel-coronavirus-2019

[34] https://www.ueunion.org/sites/default/files/stwd0420.pdf